Elder Fraud

Millions of older Americans fall prey to elder fraud every year. These scams specifically target older people who may be more trusting of con artists and have sizable nest eggs. But there are resources to help protect yourself or your loved ones from becoming a victim of these frauds.

Elder fraud consists of financial crimes that target older people’s money or property. It includes telephone, internet and mail scams.

As many as 1 in 18 “cognitively intact, community-dwelling” older Americans fall victim to an elder fraud scam every year, according to a 2017 study in the American Journal of Public Health. These are older people who do not have diminished mental states and who live on their own. They are most likely trusting people who simply don’t expect a scam.

In 2018, the Federal Bureau of Investigation reported criminal cases against more than 260 scammers who victimized 2 million Americans. The FBI estimated the losses in those cases totaled more than $700 million. But that may just be the tip of the iceberg.

Other estimates suggest as many as 5 million Americans fall victim to elder fraud every year. And the annual costs may be anywhere between $2.9 billion and $36.5 billion, according to the National Council on Aging. The council warns these estimates may underrepresent the real scope of the problem.

Protect your personal data or that of your older relatives by knowing what to look for and how to deal with scammers.

Why Scammers Target Seniors

People who grew up in the 1930s through the 1950s were usually raised to be polite and trusting of others. The Federal Bureau of Investigation warns that scammers will exploit those traits.

Older Americans are less likely to say no to a con artist. Scammers also target older people because they’re more likely to have a nest egg.

Con artists may be friendly or sympathetic in some cases or threatening in others. They may use email, online dating sites, phone calls or traditional mail to contact you. Or they may show up at your door offering a service.

Older people may also be less likely to report a scam because they don’t know who to report it to. Or they may not report it out of fear or embarrassment.

Scammers also count on the effects of age and memory to play in their favor if an older person does report them. Many victims don’t realize they’ve fallen prey to a scam until weeks or even months after it happened. This can make it difficult for a person to remember all the details that could help authorities.

Common Scams

William Webster was 90 years old when he got the first phone call telling him he’d won $72 million and a new Mercedes Benz. The Jamaican man calling him knew a lot about Webster’s past. He knew that Webster had been a judge and a U.S. Navy officer. The caller wanted Webster to send him $50,000 to collect the prize.

Webster was certain it was a lottery scam and brushed him off. But the man kept calling back. Over time, he threatened violence against Webster and his wife. He knew where they lived and warned they’d be shot if they didn’t send the $50,000.

Source: Federal Bureau of Investigation

What the caller did not know was that Webster had been the director of both the Federal Bureau of Investigation and the Central Intelligence Agency when he was younger. He’s the only person to have headed up both agencies. Webster called the FBI and helped with a sting investigation.

The bureau eventually arrested the scam artist. He pleaded guilty in October 2018 to charges that could keep him in federal prison for nearly six years.

This is just one of several types of scams that target elderly people.

Sweepstakes and Lottery Scam

Webster and his wife were the targets of a lottery scam. These are telemarketing scams that tell people they have to pay money to receive lottery winnings.

The Federal Trade Commission received 142,870 reports of scams involving prizes, sweepstakes and lotteries in 2017, according to the AARP. Such scams took $95 million from unsuspecting Americans that year, and the average individual loss was $511.

Criminals who conduct lottery and sweepstakes scams usually contact their victims by phone, email or social media to congratulate them on winning big. They may identify themselves as lawyers, customs officials or lottery representatives.

But then they will say there’s a fee for shipping, insurance, custom duties or taxes to collect the prize. They may ask for bank account information, money through a wire transfer, or they may suggest buying a gift card and giving them the card numbers.

Don’t ever pay to claim winnings. No legitimate lotteries or sweepstakes work that way.

Online Dating Scams

Con artists use legitimate dating sites, chatrooms or social media to meet potential victims. They create fake profiles and build online relationships.

They then talk their victims into sending money before disappearing forever. They may say they need the money for medical expenses, visas to get into the country, or travel expenses to meet you.

Any love interest you’ve only met online who asks for money is likely a scammer, according to the Federal Trade Commission.

Money Mule Scams

“Money mule” scams are money laundering schemes that can actually land the victims in prison. It tricks people into becoming mules, or delivery people, for criminals.

The con artist convinces the victim, or mule, to allow deposits into his or her bank account. The mule is then paid to withdraw the money, usually a little at a time, and send it to a third person.

The money comes from criminal enterprises, and the scam has become a popular way to move dirty money around the world.

Oftentimes, these scams start with a job posting or a relationship built online. The FBI warns people not to accept job offers that ask you to do this. A legitimate company will not ask you to transfer their money using your own bank account.

IRS and Tax Scams

IRS and tax scams may involve emails that claim to be from the Internal Revenue Service or tax preparation companies. They may try to steal private information to hijack your tax refund.

Con artists may also call pretending to be IRS agents and claiming you owe money. Scammers will claim you have to pay immediately either through a debit card or a wire transfer.

The IRS never asks for immediate payments over the phone, and it doesn’t threaten to bring in police to arrest you.

Tech Support Scams

People older than 70 filed the most complaints over tech support scams in 2018, according to the FBI. The Federal Trade Commission received 142,000 complaints for the year.

Tech support scammers want you to believe you have a serious problem with your computer. They try to get you to pay for software or services you don’t need.

They may try to lure you with a phone call saying they’re with Microsoft, Google or some other large tech company. Or they may use pop-up ads on websites saying your computer needs an update.

These scammers often ask for types of payments that can be hard to reverse, such as wire transfer or a prepaid gift card.

Drug Smuggling Scam

Offers of elaborate overseas trips may actually be a scam to get seniors to unwittingly smuggle drugs. The scam usually involves offering to fly people to various countries and requires they meet with the con artists’ attorneys or business partners.

The all-expense paid trip ends up with a request to take a present or some other every day item to someone on the next stop. The gift is actually packed with illegal drugs, and the victim can end up in prison if caught with it.

Grandparent Scams

In a typical grandparent scam, a con artist calls claiming a relative is in the hospital or in jail and needs money. The call may come in the middle of the night when a potential victim is groggy or confused from the sudden wake up call. The caller may even claim to be the relative.

Don’t send money, but call the relative or their parent at a number you know, not one you’re given over the phone, to confirm there’s a problem.

Red Flags

You can take some simple steps to avoid falling victim to elder fraud. It is a matter of recognizing a scam, refusing to go along with it and reporting it to police or other authorities.

These scams tend to have a lot of the same features. They’re designed to make you think about the payoff and to get you to act quickly before you suspect it’s a trick. If you know what to look for, you can avoid falling for these scams.

- PROMISES OF FREE MONEY OR FAST CASH:

- If you get a promise of free money or fast cash out of the blue, it’s likely a scam. These offers may claim you’ve won the lottery, they may tout a sure-fire investment that’ll make you rich, or they may offer a work-at-home scenario with little work for a lot of money.

- PRESSURE TO ACT FAST:

- The more time you have to think about a scam, the more likely you’re going to realize it is one. Scammers will push you to act quickly before you miss an opportunity, but they really don’t want you having time to think about how suspicious their offer is.

- IT SOUNDS TOO GOOD TO BE TRUE, IT USUALLY IS:

- Promises of getting rich quickly, winning the lottery, or getting paid a lot for little work don’t come along every day and for good reason. Scammers use the too-good-to-be-true approach to grab your attention and have you focus on the payoff instead of questioning why this landed at your feet.

How to Protect Yourself from Fraud

Asking questions and taking your time can keep you from being a victim of elder fraud. Never give out your personal information to someone who calls or emails. This includes your bank account information, Social Security number and birthdate.

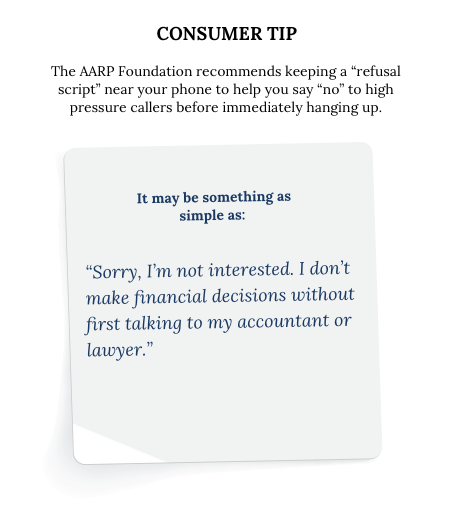

If someone asks for money over the phone, tell them no and hang up the phone. If the calls keep coming, ask lots of questions. Questions can quickly expose a scam and scare the callers away.

You should never send checks, cash or money orders to anyone you don’t personally know.

Finally, talk with friends and family before agreeing to any offer or situation that comes from an unsolicited phone call or email. Or talk with your lawyer, doctor or an officer at your bank. They may be familiar with scams and may be able to help you with solutions.

Is Your Relative a Victim?

Financial advisers and accountants may be the first to spot signs of potential elder fraud. These can include clients suddenly interested in “too-good-to-be-true” opportunities or making sudden, large withdrawals from their bank accounts.

But there are other signs relatives can look out for.

Signs of Elder Fraud

- Large or unexplained bank withdrawals

- New acquaintances suddenly accompanying them to the bank

- Sudden insufficient fund activities or unpaid bills

- Forgery or suspicious signatures on checks

- Wiring large sums of money

- Embarrassment or unwillingness to discuss the problem

- Loss of property

- Altered wills and trusts

What to Do If You Suspect Fraud

Reporting fraud can prevent scam artists from hurting other people. There are several organizations and government agencies that investigate or prosecute scammers.

If you realize you’re the victim of fraud, you should report it immediately to your local police. Also, let your bank know right away if you’ve deposited or transferred money as the victim of a scam.

Where to Report Scams

| AGENCY | TYPE OF SCAM | PHONE NUMBER |

|---|---|---|

| Federal Bureau of Investigation | Money mule scams, drug smuggling scams, lottery and sweepstakes scams, tech support scams, IRS and tax scams | 800-225-5324 |

| Federal Trade Commission | Online dating scams, and tech support scams | 877-438-4338 |

| IRS (Treasury Inspector General for Tax Administration) | IRS and Tax Scams | 800-366-4484 |

| Social Security Administration | IRS and tax scams, and any scam in which you’ve give out your Social Security number | 800-269-0271 |

| State Attorney General (National Association of Attorneys General) | All consumer-related scams including online dating, tech support, grandparent and mail-related scams | 202-326-6000 |

| U.S. Postal Service Office of Inspector General | Mail scams | 888-877-7644 |

If you’re not sure who to call, AARP’s ElderWatch program can direct you to the appropriate agencies. Call the program at 800-222-4444 and select option 2.

17 Cited Research Articles

Consumernotice.org adheres to the highest ethical standards for content production and references only credible sources of information, including government reports, interviews with experts, highly regarded nonprofit organizations, peer-reviewed journals, court records and academic organizations. You can learn more about our dedication to relevance, accuracy and transparency by reading our editorial policy.

- AARP Foundation. (n.d.). AARP ElderWatch. Retrieved from https://www.aarp.org/money/scams-fraud/elderwatch/

- AARP. (n.d.). Sweepstakes and Lottery Scams. Retrieved from https://www.aarp.org/money/scams-fraud/info-2019/sweepstakes.html

- American Bankers Association. (n.d.). Protecting the Elderly from Financial Abuse. Retrieved from https://www.aba.com/advocacy/community-programs/consumer-resources/protect-your-money/elderly-financial-abuse

- Association of Certified Fraud Examiners. (n.d.). The Fraud Examiner; Elderly Fraud Scams: How They’re Being Targeted and How to Prevent It. Retrieved from https://www.acfe.com/fraud-examiner.aspx?id=4294997223

- Burnes, D., et al. (2017, June 22). Prevalence of Financial Fraud and Scams Among Older Adults in the United States: A Systematic Review and Meta-Analysis. American Journal of Public Health. Retrieved from https://www.ncbi.nlm.nih.gov/pubmed/28640686

- Federal Bureau of Investigation. (2018, February 22). Elder Fraud. Retrieved from https://www.fbi.gov/news/stories/elder-fraud-charges-announced

- Federal Bureau of Investigation. (2019, March 7). Foiling an Elder Fraud Scam. Retrieved from https://www.fbi.gov/news/stories/former-fbi-director-william-webster-helps-foil-fraudster-030719

- Federal Bureau of Investigation. (2019, March 7). Results of Elder Fraud Sweep Announced. Retrieved from https://www.fbi.gov/news/stories/results-of-elder-fraud-sweep-announced-030719

- Federal Bureau of Investigation. (n.d.). Fraud Against Seniors. Retrieved from https://www.fbi.gov/scams-and-safety/common-fraud-schemes/seniors

- Federal Trade Commission. (2019, February). How to Spot, Avoid and Report Tech Support Scams. Retrieved from https://www.consumer.ftc.gov/articles/how-spot-avoid-and-report-tech-support-scams

- Grant, K.B. (2017, August 28). $36 Billion Might Be a Low Estimate for this Growing Fraud. CNBC. Retrieved from https://www.cnbc.com/2017/08/25/elder-financial-fraud-is-36-billion-and-growing.html

- Jackman, T. (2019, February 11). William Webster, Ex-FBI and CIA Director, Helps Feds Nab Jamaican Phone Scammer. The Washington Post. Retrieved from https://www.washingtonpost.com/crime-law/2019/02/12/william-webster-ex-fbi-cia-director-helps-feds-nab-jamaican-phone-scammer/?utm_term=.393ee292a803

- Leiber, N. (2018, May 3). How Criminals Steal $37 Billion a Year from America’s Elderly. Bloomberg. Retrieved from https://www.bloomberg.com/news/features/2018-05-03/america-s-elderly-are-losing-37-billion-a-year-to-fraud

- National Council on Aging. (n.d.). Elder Abuse Facts. Retrieved from https://www.ncoa.org/public-policy-action/elder-justice/elder-abuse-facts/

- U.S. Department of Justice. (n.d.). Senior Scam Alert. Retrieved from https://www.justice.gov/elderjustice/senior-scam-alert#SS02

- U.S. Immigration and Customs Enforcement. (2016, February 10). DHS Officials Issue Warning About Scams Targeting Senior Citizens to Unknowingly Act as International Drug Smugglers. Department of Homeland Security. Retrieved from https://www.ice.gov/news/releases/dhs-officials-issue-warning-about-scams-targeting-senior-citizens-unknowingly-act

- U.S. Internal Revenue Service. (2019, March 15). Tax Scams/Consumer Alerts. Retrieved from https://www.irs.gov/newsroom/tax-scams-consumer-alerts

Calling this number connects you with a Consumer Notice, LLC representative. We will direct you to one of our trusted legal partners for a free case review.

Consumer Notice, LLC's trusted legal partners support the organization's mission to keep people safe from dangerous drugs and medical devices. For more information, visit our partners page.

844-420-1914